Did you hear the exciting news? Road projects are beginning to ramp up in Norwood. That’s right, friends! We recently finished re-paving a stretch of Forest Ave in Ward 3 and are about to start work on Section Ave in Ward 4. Council has even decided to set aside funds so that the new mayor, whoever that is, can hit the ground running in 2020. Yipee!

While it’s a sign of progress to be sure, it comes with a startling realization. When you dig into the cost of these projects, and other proposed work, you begin to understand how a city goes bankrupt. Allow me to explain.

The Rat Race of Road Repair

Section Avenue is the dividing line between Norwood and Cincinnati… and it shows. In what seems like a subtle taunt, the west side of Section Ave — the Cincinnati side — is paved, while the Norwood side is not. See here:

To repair 0.4 miles of Section Ave, Council has approved spending $150,000. While I have no idea if that is a good price (I trust that it is), I do find this concerning, and here’s why. According to the Hamilton County Auditor’s site, the 42 parcels on the Norwood side of that street contributed a combined $5,478 to Norwood’s coffers in 2018 through property taxes.

In other words, it’s going to take the residents of Section more than 27 years worth of property taxes to pay for the revitalized road in front of their house

($150,000 divided by $5,478 equals 27.4 years). And that’s ALL of their property tax dollars. None would be left over for other city functions. Let me say that again to emphasize how staggering that figure is.

It’s going to take the residents of Section Ave. more than 27 years worth of property taxes to pay for the revitalized road in front of their house.

The problem with that, of course, is that the Ohio Auditor mandates that roads need to be resurfaced on a 15-year cycle. That means that Section Ave will be re-paved again in 2034, even though it’s going to take until 2047 to pay off their “2019 work.”

Do I have your attention?

Along with Section Ave, two other road projects were priced out by JMA Consultants. Those were a two-lane, 0.24 mile stretch of Sheridan Road, and a two-lane, 0.6 mile stretch of Indian Mound Ave. Although those projects are NOT proceeding in 2019, it’s still illuminating to know that an outside firm priced those at combined $365,000.

Again, the problem with that figure is that the 138 parcels on Indian Mound and Sheridan that stand to “benefit” from this road repair combine to pay $35,697 in property taxes each year. In other words, those projects are going to take more than 10 years worth of property taxes to pay off. ($365,000 divided by $35,697 = 10.2 years). Yes, that’s less time than the Section Ave repair, but the gist remains the same: long-term burden.

But Jon, you’ve only mentioned property tax. You need to account for income tax!

The reason I haven’t accounted for income tax yet is because other people have already done that for me. You see, Norwood generates roughly $17M in income tax every year, which is nearly the exact same amount we have budgeted in 2019 to spend on police, fire, dispatch and public lands & buildings.

To be clear, your income taxes do not go directly to police, fire, dispatch and public lands & buildings — they go into a general fund and then are portioned out. But, effectively, the income tax the city brings in is equivalent to what the city spends on those four line items.

That means that pretty much everything else the city does — parks, roads, community center, recreation department, health department, public works, salaries for elected officials, etc. — needs to be paid for by the revenues generated by property taxes, which was about $2.7M in 2018.

To summarize, all of the income tax that the folks on Section Ave pay each year will, effectively, go to police, fire, dispatch and public buildings & land. All of the property tax that the folks on Section Ave pay for the next 27 years will, effectively, go toward paying for the repaired road in front of their house. In the end, there are no dollars left for the folks on Section Ave to contribute to any of the other functions that the city carries out.

Does that mean that those Norwoodians will be unable to use those resources and community assets for years to come? Of course not! It just means everyone else will be subsidizing their use… despite the fact that we’re all going to have to pay for the roads in front of our houses at some point. Sooner or later, we will all “be” the folks on Section Ave.

But Jon, if it takes 10- or 20-years worth of property taxes to pay for the road work that’s happening, what happens all those other things — the parks, the community center, the recreation department — in the mean time?

Exactly what’s happening right now: they sit neglected. They go underfunded. As they deteriorate, they become harder and more costly to repair. It’s expensive to be poor. This is how a city goes bankrupt.

Maybe the bankruptcy isn’t literal, since cities can’t file bankruptcy, but it’s metaphorical. Without useful parks, safe roads, and interesting activities, why live in a place? And if mobile, affluent residents move away for greener pastures, guess what, the city loses revenue again still… and down the slippery slope we go.

The funding choices become a game of whack-a-mole. Maybe put a little money to parks this year, and then next year we’ll fund some roads. But it’s impossible under our current system to ever get ahead. It’s inherently a shell game that a community can’t win. Maybe the most startling thing of all is that this predicament isn’t unique to Norwood. It’s happening everywhere in America.

And to be clear, there ARE outside funds available from different entities to help pay for our roads and other projects, but at the end of the day, our city is fundamentally unable to be self-sufficient, as it currently exists.

What options do we have?

In short, if we ever want to escape the rat race, we have four levers to pull. I’ll expand upon them in future posts, but here’s the gist:

- Increase income taxes

- Reduce the cost of fire and/or police

- Increase property values and/or property taxes

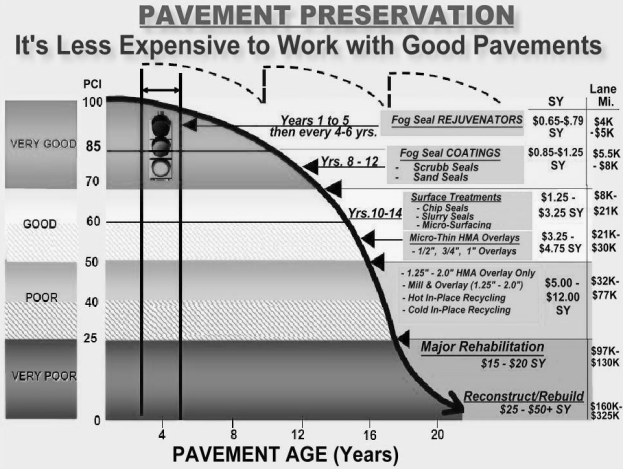

- Reduce the cost of roads

That’s it. All conversations about bettering Norwood have to link back to one of these four factors. They are both the obstacle and the way forward. So when you hear people talking about walkability, or adopting a charter, or business development… know that it’s not just because it sounds cool. It’s not just for shits and giggles. Those initiatives all make economic sense.

While I know this article is a buzzkill, I’m encouraged. I’m encouraged because we now have a diagnosis. We know what’s wrong and we have a common language to discuss the problem. From here, we can begin to discuss ideas. Anything that moves the arrow on one of those four factors needs to be on the table. There are no bad ideas. We face a tall task, but I’m optimistic that we can come together to overcome this. Our future depends on it.

Interesting. Insightful. Well written. Nice article Jon

Very nice article and thank you.

What about the tax revenue from from all of the businesses or have they all received tax abatement’s? Why isn’t there a professional city manager? That might solve alot of problems.

Nice work Jon.

Great article Jon! Could you provide the source for your graph?

If we make Norwood a city focused on walking, then the roads wouldn’t be as critical. I think about my time living in Oxford, Ohio. Driving was not convenient, and if you parked you pay. If you drive, pedestrians always have the right away. You just did not want to drive there. What if we made changes to Norwood to make it similarly annoying? All important to think about.

I, like Katy, would like to know where the revenue from business property tax is going. Tax abatement should only be a temporary break not permanent, like UDF for instance. Are we getting some other type of revenue from them? This is something I’m going to look into. Big businesses should be able to pay taxes more than small business, more than residents and we need to visit these policies.

This is a fantatically succinct summary and explanation. Well done.